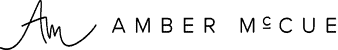

If you are operating in your zone of genius, the value of what you offer is priceless. But priceless doesn’t pay the bills.

The question then, is how much DO you actually charge?

Talk about a loaded question! Like we talked about last week, it’s not about charging what you’re worth, but aligning the value of your products and services with what the market and your ideal client will pay for your products + services.

The good stuff begins when you find the sweet spot between the value of your products and services and what the market will bear. To uncover your sweet spot you need to match up these key areas.

You’re probably thinking, the sweet spot sounds good, but how on earth do I figure THAT out? Don’t worry, I’ve got you covered.

Step #1. Conduct a Market Analysis

Understanding your market and your customer is a whole area to dig into unto itself. From ideal client avatars to market research by surveying your audience to know what they truly desire and segmentation and understanding the competition, there’s an abundance of information to cover under the market analysis umbrella.

But we’re going to get laser focused on the need-to-know so you can implement and test your pricing with confidence: understanding your customer and your market.

The client is at the heart of everything we do. Without them our growth comes to a screeching halt. So before we step into pricing our products and services, it’s important to clearly understand our customers’ needs, desires, wants, and values. And most importantly, what they’re willing to spend.

Even if you don’t spend thousands of dollars on market research, consider your client: are they budget conscious? Interested primarily in convenience? Or does your client have an interest in maintaining status?

Know your people. Gear up to serve your people. Price accordingly

Then there’s what’s going on in the market as a whole. Because your clients likely know who your competition is. You should get to know them as well, but don’t get caught in a comparison cycle. Your pricing will not be exactly the same as your competition’s because you offer something different and have a unique value proposition. Use this information only as an initial gauge of what the market will bear.

As you differentiate yourself and your pricing, consider your uniqueness, brand promise, values, key differentiators and overall customer experience.

Finally, think about what the market needs. Does it need more accessible products? Innovation? More integrity? That’s where you set yourself apart and price accordingly.

Step #2: Determine Your Revenue Target

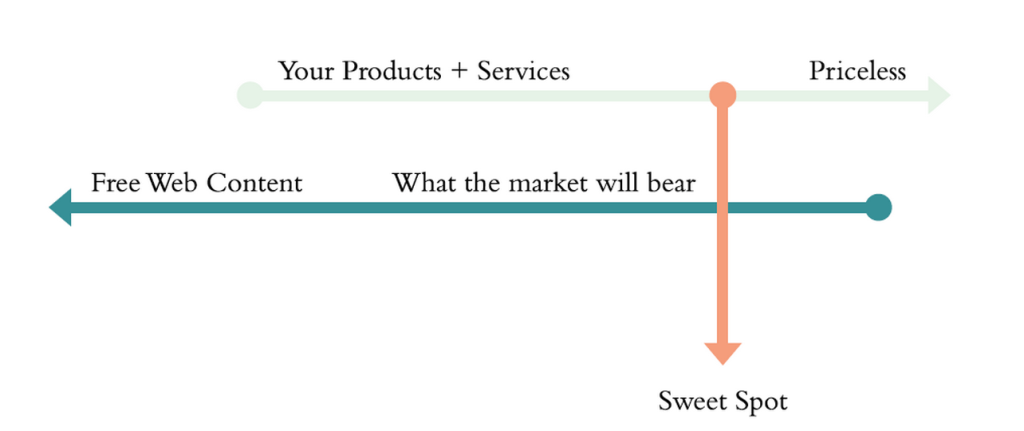

Pricing is directly tied to your revenue, so let’s take it from the top. You need a revenue target.

How much money do you want your business to bring in this year?

This gross revenue is like a salary paid by an employer, so there’s going to be deductions for benefits and taxes, so that’s not what you take home. That needs to be factored into your pricing. So if you know that you’ve got 20% of “other” costs, you need to account for that as you reverse engineer your pricing.

As you think about the individual price point for each of your products, also consider:

Marketing Perception: Can your products easily be scooped up at the

local big-box store? If so and you want to charge more than what the local big-box store does, it doesn’t mean you can’t charge more — You simply build your products and services in a way

that differentiates you from them and market to a different client base.

Estimated Volume: How much do you want to sell? If you have a lower price point, you may need to have a higher volume of sales to meet your revenue target. If you have a higher price point, you may have to sell to less people at that higher rate to attain your revenue target.

Marketing Reach: When starting out or offering a new product, a business may offer discounts or introductory pricing to drum up buzz. Introductory pricing makes it easier for some people to buy and gives a business owner an opportunity to get the word out quickly. It’s helpful that these services or products be buzzworthy and top notch so people want to talk about them and share how stinkin’ fabulous you are so the word spreads and you get a strong return on the investment you made in your introductory pricing.

Visibility of Offering: If you don’t have high-levels of traffic to your site yet, you don’t attend networking events, or do other marketing, etc. consider how you’ll increase visibility to your products or services to drive people to buy.

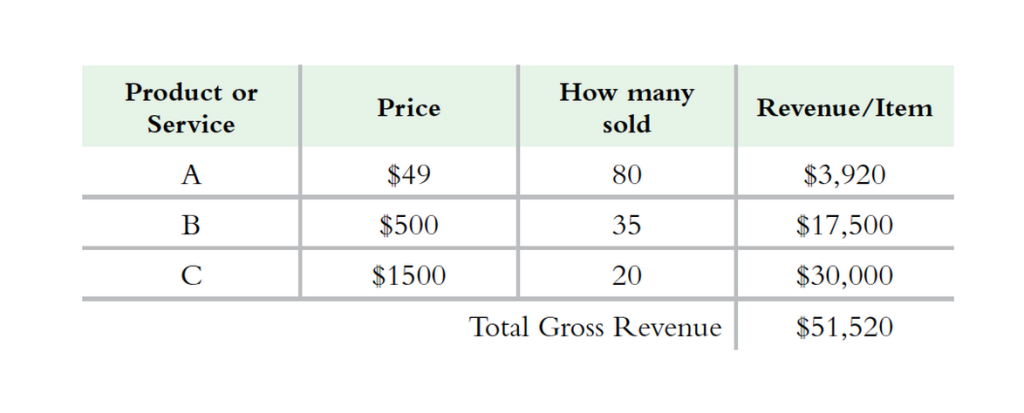

Step #3. Set Your Profit Target

With your revenue target ready to roll, now it’s time to focus on profit. Bring on the money, honey, because revenue without an eye on profit can be a big old problem!

Your profit is your revenue minus expenses.

This is the amount of money your business has after sales are generated and expenses are paid. In the salary example, it is the amount that remains after taxes and benefits, for example, are deducted.

Even in the most streamlined businesses, to get your products and services out the door, there will be expenses. Even in a business that primarily has an online presence with no actual products being manufactured, there will be expenses associated with taking your

products to market. We’re talking things like website maintenance and PayPal fees.

If you’re running a service-based business, your time is an expense to track as well.

By looking at profit you might also identify a need to reset on your revenue model or reset your pricing strategy to make sure you don’t sacrifice profit:

In the example “A” above, you might wonder “is it really worth the time, energy, and expense it will take to create a product that will cost $3,000 to get to market, but it will generate only $920 in profit?”

Darn good question!

As you assess your revenue and profit targets, don’t hesitate to change your game plan based on your findings. Your goal should be to commit to profitable growth.

With these three steps out of the way, you’re likely ready to set your pricing. But do you go hourly? Project-based? Value? Flat-Rate? Next week we’ll walk through each of your options and when it’s the ideal time to bust out each one.

Comment below on which of these three steps you’re going to spend some time on so you can make sure your pricing is right on the money.